All Categories

Featured

Table of Contents

[/image][=video]

[/video]

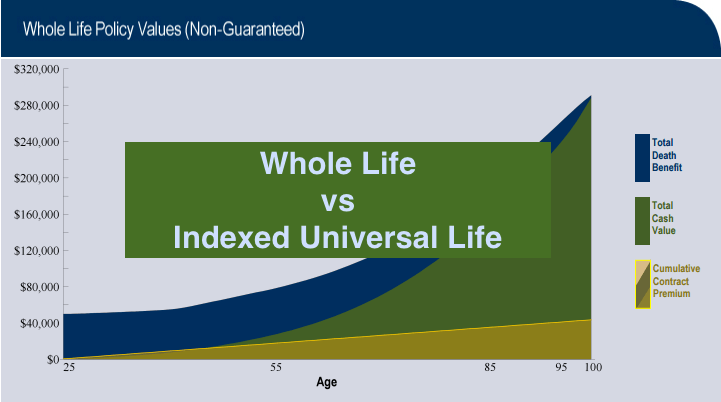

The plan acquires worth according to a dealt with schedule, and there are fewer fees than an IUL policy. A variable plan's cash money worth might depend on the efficiency of details supplies or various other protections, and your costs can additionally change.

An indexed global life insurance coverage policy consists of a death advantage, in addition to a part that is tied to a supply market index. The cash money worth development depends upon the efficiency of that index. These plans provide greater potential returns than other kinds of life insurance policy, as well as higher threats and additional charges.

A 401(k) has more investment alternatives to select from and might come with a company match. On the other hand, an IUL comes with a death advantage and an added money value that the insurance policy holder can borrow versus. They likewise come with high costs and costs, and unlike a 401(k), they can be terminated if the insured stops paying right into them.

These plans can be a lot more complex contrasted to various other kinds of life insurance policy, and they aren't necessarily ideal for every financier. Talking to an experienced life insurance policy agent or broker can assist you determine if indexed universal life insurance is an excellent suitable for you. Investopedia does not offer tax obligation, investment, or monetary services and suggestions.

Indexed Universal Life Insurance

IUL plan cyclists and modification choices enable you to customize the plan by enhancing the fatality benefit, including living benefits, or accessing cash money worth previously. Indexed Universal Life Insurance (IUL Insurance) is a long-term life insurance policy policy offering both a death benefit and a cash money worth element. What sets it apart from other life insurance policies is exactly how it manages the investment side of the cash value.

It is essential to keep in mind that your money is not directly invested in the stock exchange. You can take cash from your IUL anytime, however charges and give up charges may be related to doing so. If you require to access the funds in your IUL policy, evaluating the benefits and drawbacks of a withdrawal or a finance is necessary.

Unlike straight investments in the supply market, your cash money value is not straight bought the underlying index. Instead, the insurance provider uses economic tools like alternatives to connect your money value growth to the index's performance. Among the distinct features of IUL is the cap and flooring prices.

Pacific Discovery Xelerator Iul 2

Upon the policyholder's fatality, the recipients receive the fatality benefit, which is generally tax-free. The survivor benefit can be a fixed amount or can include the cash worth, relying on the policy's framework. The cash money worth in an IUL plan expands on a tax-deferred basis. This indicates you do not pay tax obligations on the after-tax resources gains as long as the cash remains in the policy.

Constantly evaluate the plan's information and talk to an insurance coverage specialist to completely understand the benefits, limitations, and expenses. An Indexed Universal Life Insurance policy (IUL) offers an one-of-a-kind mix of features that can make it an attractive alternative for specific individuals. Right here are several of the essential advantages:: Among the most attractive aspects of IUL is the potential for greater returns compared to various other sorts of long-term life insurance policy.

Taking out or taking a car loan from your plan may reduce its money worth, survivor benefit, and have tax obligation implications.: For those thinking about legacy planning, IUL can be structured to provide a tax-efficient method to pass wide range to the future generation. The death benefit can cover estate taxes, and the cash worth can be an extra inheritance.

While Indexed Universal Life Insurance Policy (IUL) supplies a variety of advantages, it's necessary to think about the potential downsides to make a notified decision. Here are some of the essential disadvantages: IUL plans are a lot more intricate than conventional term life insurance policy plans or whole life insurance plans. Understanding exactly how the money value is connected to a stock market index and the implications of cap and floor rates can be challenging for the ordinary consumer.

Indexed Universal Life Insurance Policies

The premiums cover not only the cost of the insurance policy but additionally management costs and the financial investment element, making it a more expensive choice. While the money worth has the capacity for growth based on a stock exchange index, that growth is often capped. If the index carries out remarkably well in a provided year, your gains will certainly be restricted to the cap price specified in your plan.

: Adding optional functions or cyclists can raise the cost.: Just how the plan is structured, consisting of just how the cash money worth is assigned, can also influence the cost.: Various insurance policy companies have different rates models, so searching is wise.: These are costs for taking care of the plan and are normally subtracted from the cash money worth.

: The costs can be similar, yet IUL uses a flooring to help secure against market declines, which variable life insurance policy plans generally do not. It isn't very easy to give a specific expense without a certain quote, as costs can differ significantly in between insurance policy providers and individual scenarios. It's crucial to stabilize the relevance of life insurance and the demand for included protection it offers with potentially higher premiums.

They can help you understand the costs and whether an IUL policy lines up with your monetary objectives and requirements. Whether Indexed Universal Life Insurance (IUL) is "worth it" is subjective and depends upon your monetary goals, danger resistance, and lasting planning demands. Right here are some indicate take into consideration:: If you're seeking a lasting financial investment vehicle that provides a death advantage, IUL can be a good alternative.

Shield your loved ones and save for retirement at the very same time with Indexed Universal Life Insurance Policy.

Iul Insurance Companies

Indexed Universal Life (IUL) insurance policy is a sort of irreversible life insurance plan that combines the features of conventional global life insurance coverage with the capacity for cash worth development linked to the efficiency of a stock exchange index, such as the S&P 500. Like various other types of irreversible life insurance coverage, IUL supplies a survivor benefit that pays to the beneficiaries when the insured dies.

Cash value buildup: A portion of the costs repayments goes right into a money worth account, which earns interest gradually. This cash worth can be accessed or borrowed versus throughout the insurance policy holder's lifetime. Indexing alternative: IUL policies supply the opportunity for money worth development based on the efficiency of a stock market index.

Just like all life insurance policy products, there is likewise a set of dangers that policyholders ought to recognize before considering this kind of policy: Market risk: Among the key risks associated with IUL is market threat. Because the money worth growth is linked to the performance of a securities market index, if the index performs poorly, the money worth may not grow as expected.

Index Universal Life Insurance Companies

Adequate liquidity: Policyholders need to have a stable financial scenario and be comfy with the superior payment needs of the IUL policy. IUL permits versatile premium repayments within certain limitations, but it's vital to maintain the policy to guarantee it attains its desired objectives. Rate of interest in life insurance coverage: Individuals that require life insurance policy protection and a rate of interest in cash money value development may find IUL attractive.

Candidates for IUL should have the ability to recognize the technicians of the plan. IUL may not be the very best option for people with a high resistance for market threat, those that focus on affordable financial investments, or those with more instant monetary requirements. Consulting with a certified monetary consultant who can supply personalized support is essential prior to taking into consideration an IUL policy.

All registrants will certainly obtain a calendar invite and link to sign up with the webinar using Zoom. Can't make it live? Register anyhow and we'll send you a recording of the presentation the next day.

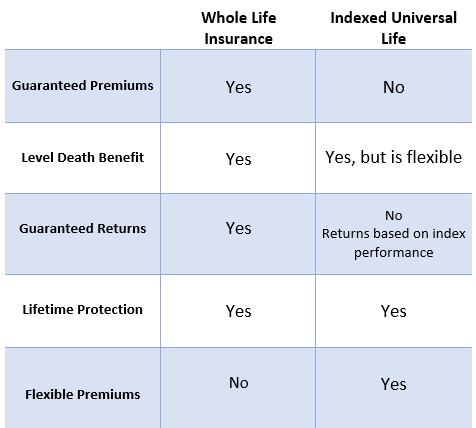

Universal Life Insurance: What It Is, How It Works - Guardian

A entire life insurance policy plan covers you for life. It has cash money value that grows at a set passion price and is one of the most common kind of irreversible life insurance policy. Indexed global life insurance policy is additionally permanent, yet it's a details type of global life insurance with cash money value tied to a securities market index's performance as opposed to non-equity earned rates. Policyholders can shed money in these items. Policy lendings and withdrawals might develop an unfavorable tax result in the event of gap or plan abandonment, and will reduce both the surrender worth and survivor benefit. Withdrawals might be subject to taxes within the initial fifteen years of the agreement. Customers ought to consult their tax consultant when thinking about taking a policy funding.

It needs to not be thought about investment advice, neither does it comprise a recommendation that anybody participate in (or avoid from) a specific strategy. Securian Financial Team, and its subsidiaries, have a monetary interest in the sale of their items. Minnesota Life Insurance Coverage Business and Securian Life Insurance policy Firm are subsidiaries of Securian Financial Team, Inc.

In case you select not to do so, you need to think about whether the product concerned is suitable for you. This website is not an agreement of insurance coverage. Please refer to the policy agreement for the specific terms and conditions, certain information and exemptions. The plan discussed in this page are shielded under the Plan Proprietors' Defense System which is carried out by the Singapore Down Payment Insurance Policy Firm (SDIC).

To find out more on the kinds of benefits that are covered under the system as well as the limits of protection, where relevant, please call us or see the Life Insurance coverage Organization, Singapore or SDIC websites () or (www.sdic.org.sg). This promotion has actually not been reviewed by the Monetary Authority of Singapore.

Latest Posts

Best Indexed Universal Life Insurance Policies

Iul Illustration

Iul Index Universal Life